Why Building Brand Capital Matters For Founders

And Seven Things Founders Must Get Right

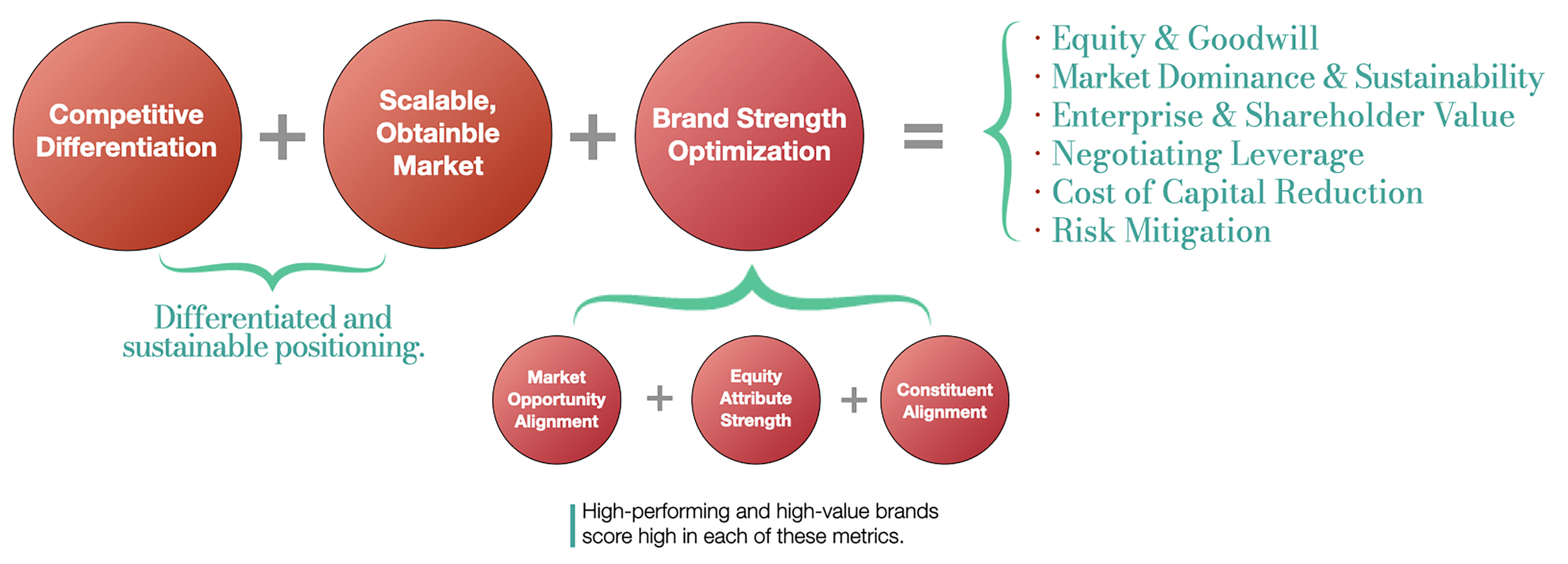

Brand Capital refers to the collective intangible assets a company creates by integrating strategy with creativity in the process of building compelling and ownable differentiation. It’s an asset that is leveraged for competitive advantage and long-term profit. It connects the brand’s intangible brand equity directly to capital efficiency and market performance, improving funding and investment outcomes.

It is one of the most powerful forms of capital a startup can have. Investors are always calculating risk. If your brand positioning is unclear or your brand looks like every other startup in your space, the risk feels higher. And when the risk is higher, investors want more equity.

When your brand is clearly positioned and emotionally potent, you’re building brand capital. Investors see a safer, more promising opportunity. Risk and opportunity costs decrease, your valuation increases, and you give up less equity. In financial terms, a strong brand lowers the discount rate that investors apply to your future earnings.

Financial capital that’s invested wisely compounds. Brand capital works the same way. Your brand’s positioning, narrative, design, and messaging either build or erode equity. The benefits of a strong, consistent brand compound over time, fueling customer preference, building engaged employees, attracting partners, and attracting investors. It becomes a flywheel. Every dollar of financial capital you raise works harder because your brand capital multiplies its impact, lowers the cost of capital, and compounds enterprise value over time. You are building equity and brand capital to be leveraged.

How To Build Your Brand Capital

The most common reason startups fail isn’t the idea. It’s the lack of alignment between the idea, defining the opportunity, the strategy, and the creative expression of the opportunity.

Founders often focus obsessively on product-market fit, market size, or traction metrics. And well they should. But what’s often overlooked is the core strategic foundation that ties it all together: positioning, differentiation, messaging, and brand strategy. The elements that build brand capital and a foundation for long-term equity.

Let’s get this clear up front: Your brand and your business are the same thing. Brand positioning and company positioning are one and the same.

And this: Brand is a strategic construct well before it’s any kind of tactical execution, logo, color, or font. Everything about a brand, its positioning, and its attributes connect to business strategy and stakeholder objectives. Positioning is the foundation that builds alignment and consistency, and this builds equity. It doesn’t matter what you are building. Get this right first because brand equity is where the money is buried.

A startup's positioning shapes how the business is perceived in a world where perception drives valuation. This work is created to have appeal and impact on your target, but it invariably has, and should have, the same impact on potential investors. Investors fund potential. And the way that potential is positioned, packaged, and expressed matters. Getting this foundation right is the difference between being perceived as a bet versus a tangible, lower-risk opportunity with a high likelihood of future success. A strong idea, with a differentiated and sustainable positioning with compelling brand attributes, opens investors’ wallets.

Strategy and Creativity Together Build Brand Capital

A strong brand tells a simple and persuasive story that investors can believe in and want to be a part of. A well-structured brand foundation and strategic plan tell investors that you’ve considered everything. You’ve thought through GTM and scaling, you know how your brand differentiates, rationally and emotionally, and that you understand clearly how you will execute. Because even the best ideas necessarily rely on execution. I don't care how good the idea is; if investors feel you can’t execute, it’s over.

Developing positioning is the heart of this process. It defines where you sit in the market, where you play, who you play with, how you win, and what makes you uniquely differentiated. If there is no succinct positioning, then it’s clear that the foundational strategic and brand development work was not done. Without this, it’s tough to tell an aligned story. Investors will see the holes.

A strong, differentiated position can reframe a category. It can invent a new one. It can thrive on features and benefits, or it can differentiate emotionally. Or both. Once typically siloed, to be most effective, strategic development and creative development must work together. They are necessarily connected. Separated, your story is disjointed, and here again, investors will see the holes.

Defining a company’s position, its strategic plan, marketing sizing, scaling strategy, GTM planning, financial modeling, capital requirements, and the pitch deck are all developed in a fluid, holistic process. Each of these things gets refined as the process unfolds, until all aspects of the business are aligned in a seamless and resonant story. This is how you establish brand capital and be in a position to build equity.

What makes brands come alive, hold value, and build capital are the intangibles. Brand love, preference, loyalty, advocacy, trust, salience, affinity, and emotional binding. All of these drive market performance and equity value. While these intangibles are not easy to measure, they are some of the largest drivers of sustainable market performance and financial value. Investors can then see a company that has already de-risked many of the subjective elements that can undermine early-stage businesses.

Here’s what founders should remember:

“Companies with strong brands tend to be acquired for more than twice the price of companies with weak brands.”

Byron Sharp, Professor of Marketing at the Ehrenberg-Bass Institute for Marketing Science“Brand equity is a key factor in attracting strategic buyers and achieving higher

transaction multiples.”

Tom Peters, Management Consultant and Author.

And this:

The consistent finding across multiple authoritative studies is that intangible assets and goodwill combined (a significant portion of which is brand) represent 75-90% of the average business acquisition purchase price, making them the dominant component of M&A valuations today.

2024 KNAV CPA Purchase Price Allocation StudyThree-fifths of chief executives said they believed corporate brand and reputation represented more than 40% of their company’s market capitalization.

Siegel+GaleBrand is an organization’s largest intangible asset, making up approximately 20% of its market capitalization value.

Brand FinanceB2B startups with strong brands realize 15%-25% higher valuation premiums.

CB InsightsStrong brands achieve triple the sales volume of weaker brands and command a 13% price premium on average.

Millward Brown

In short, brand isn’t cosmetic. Brand is capital that builds equity.

You’re Selling Belief

Creative storytelling isn’t just for customers. People make decisions emotionally, then justify them rationally. Psychological research has shown repeatedly that stories outperform statistics when it comes to persuasion. When investors hear your story, their defenses drop. They stop analyzing and start imagining. Story comes from, and aligns with, your positioning.

A story without strategy is just theater. And a strategy without a story is just a spreadsheet. You need both. Strategic and creative integration matter. Together, they transform information into belief, and belief into capital. And the psychology of it matters. Investors want to believe they’ve discovered the next great thing. They want to tell their LPs, their partners, and their networks that they backed the company everyone else missed. That emotional reward is a powerful motivator. This emotional draw isn’t soft. It translates into faster closes, better terms, and more supportive investors. And it’s only possible when the rational side of strategy and the emotional side of creativity are fused into one narrative. Give them a story to tell.

Take Warby Parker, For Example

When Warby Parker launched in 2010, the eyewear market was dominated by Luxottica, which controlled pricing, distribution, and retail. Founders Neil Blumenthal, Andrew Hunt, David Gilboa, and Jeffrey Raider didn’t just launch a cheaper pair of glasses. They positioned themselves as the anti-Luxottica: stylish, socially conscious, and disruptively direct-to-consumer.

Their positioning hit: “Glasses are overpriced because one company controls the market. We’re here to change that. And we’ve made it easy.” That positioning was their brand differentiation. It redefined an industry narrative and gave investors a clear, emotionally compelling reason to believe in their upside.

Their creative storytelling, playful tone, iconic aesthetic, and social mission made them memorable and irresistible. They created a strategic and creative foundation that built brand capital and resonated with both customers and investors. They became the brand that would democratize eyewear. Investors leaned in, in a big way.

As of today’s writing, Warby Parker is valued at over $3.3B in market cap and has redefined the category. But the foundation was set long before they hit scale. It was their integrated positioning and brand story that gave them momentum, lowered their perceived risk, and made them attractive to investors.

Brand Strength Is A Competitive Moat

When your business looks and sounds like everyone else’s, investors default to spreadsheets. They compare your TAM, your burn rate, and your CAC/LTV ratio. You become seen as a commodity.

When you build distinctiveness into your brand, you’re harder to compare—and that’s a competitive advantage. Differentiation drives resilience, and resilience attracts capital. Differentiation is rarely born from numbers alone or from creativity in isolation. It’s born from aligning your strategic truth with creative expression.

Getting funded is about proving what it could become. It’s part data and part magic, both strategic and creative.

Here’s what founders must get right before stepping in front of investors:

Clearly define your positioning. What makes you different, better, and valuable in your category? This isn’t a tagline or a logo, not to say that those don't matter, but they come later and must align with positioning. Positioning is the strategic truth that drives every decision.

Integrate strategic development with creativity, brand attributes, and narrative development. Don’t silo your processes; integrate them.

Build a succinct and ownable brand positioning, brand foundation, brand narrative, messaging, and identity. All aligned and emotionally intelligent. These are the tools needed for alignment, and alignment creates consistency. Consistency builds meaning and understanding. It all builds brand capital. And brand capital builds equity.

Make sure the positioning, the planning, the fiancials, and the story are one cohesive whole. This is how you move from information to inspiration. Everything must align with the story.

Express the opportunity creatively. Great pitch decks are more than data. They’re a performance designed to sell. They deliver belief. Use quality writers and designers. Perception matters, so quality execution matters.

Treat your brand like the capital asset it is. Just as you wouldn’t under-invest in product or tech, you cannot under-invest in the strategic and creative work that builds perception, demand, and long-term performance.

Be a brand-centric leader. Building a brand does not come from incremental spend. It comes from how you run your business. It comes from aligning every touch point and customer engagement around a cohesive positioning. Being brand-centric is an operating best practice.

There’s a growing recognition that startups with strong, integrated brand foundations are not just easier to fund, they’re easier to scale, easier to lead, and easier to sell.

You’re not just building for your raise. You’re building for long-term enterprise value. You’re building an asset that will enhance transaction multiples, reduce capital costs, and increase the likelihood of a successful exit.

So, Founder, are you building your brand capital? Hit us up for a free consultation, we can get you on track.